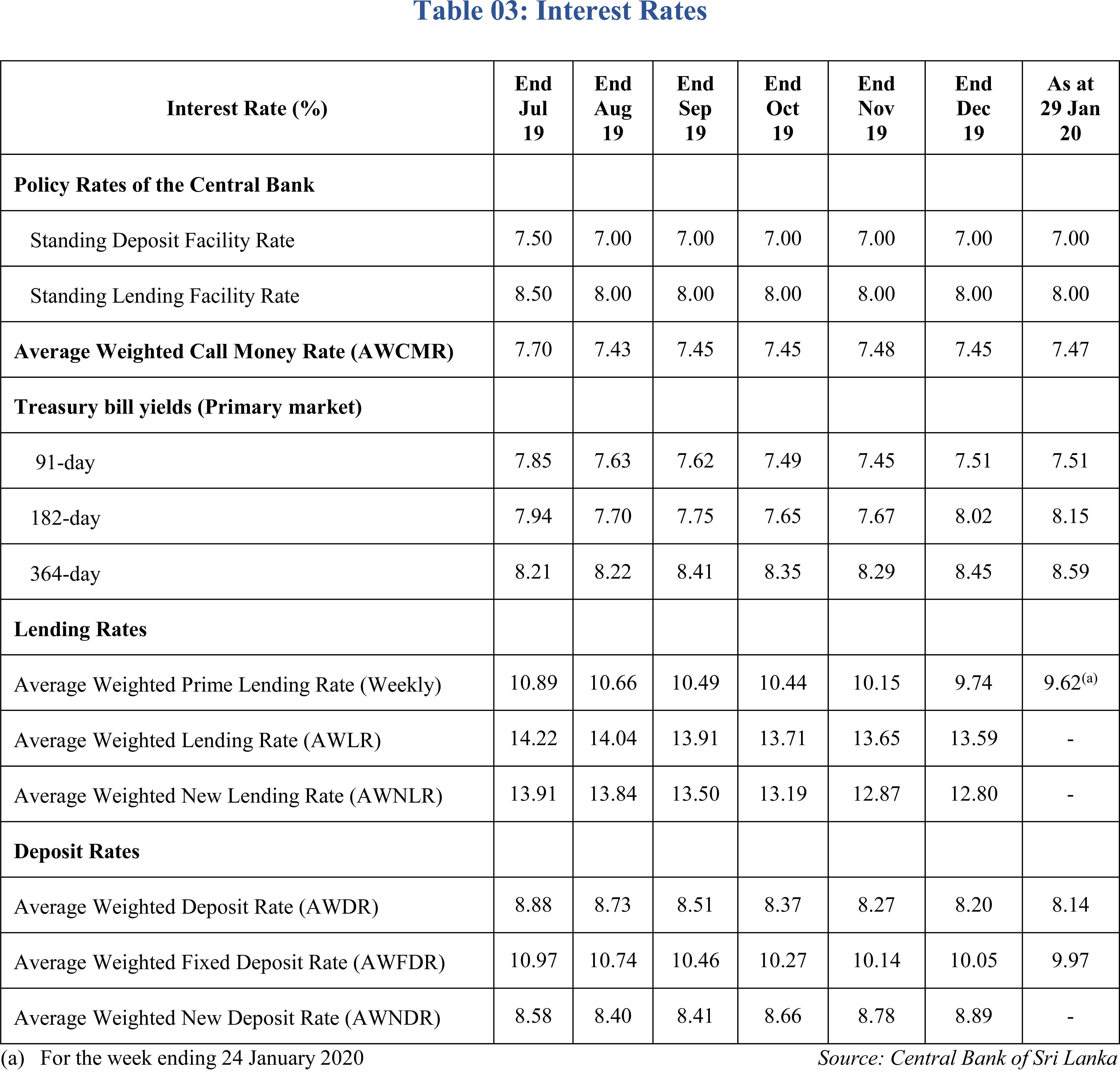

Market lending rates have adjusted downwards, in response to monetary and regulatory measures taken by the Central Bank, but the pace of reduction has decelerated.

The Central Bank said the reduction in lending rates thus far, except for the Average Weighted Prime Lending Rate (AWPR), has been less than envisaged.

“With the removal of caps on deposit interest rates offered by banks, new deposits rates have increased since September 2019,” the Central Bank said.

“Yields on Treasury bills have trended upwards at recent auctions. If not addressed, these trends could result in an undesirable turnaround in market lending rates.”